Over the past few years there has been some quite sensationalist journalism in our major papers regarding the hybrid sector and some of the recent issues that have come to market. I thought I would put the issues raised into context by using an example of a recent issue that forms part of the FYM Income Portfolio, ANZ Capital Notes 2 (ANZPE).

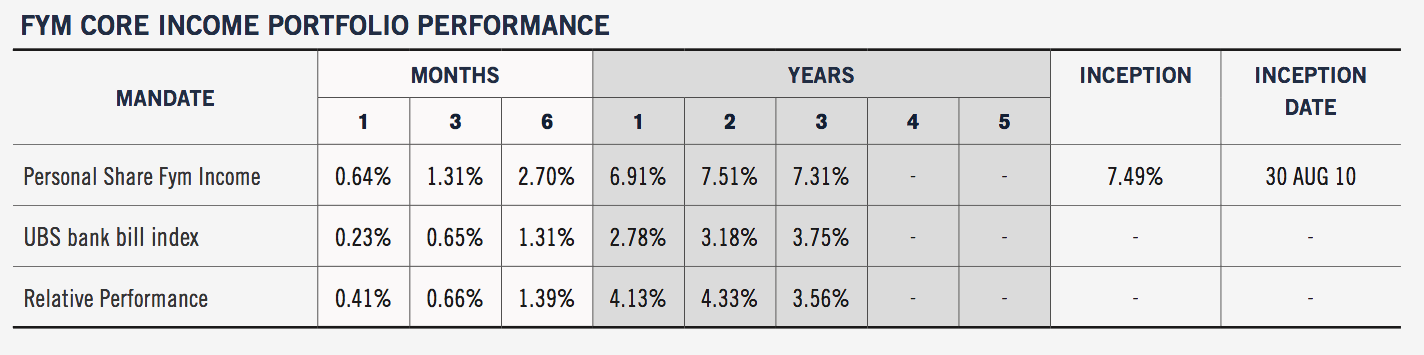

By way of background, the FYM Income portfolio aims to achieve a return of 2% above the deposit rate after costs, with low volatility (a high degree of capital stability). The portfolio has been running for almost 4 years now and has comfortably achieved its objectives. The return since inception is 7.49% (over 8.5% including the value of franking credits) and has never posted a negative quarterly return. (see FYM Core Income Portfolio Performance table below)

Some of the securities are simple debt securities and pay a fully taxable interest payment and others, particularly the Bank securities, pay a distribution that is fully franked.This means that the company has already paid tax on the distribution at the corporate tax rate and the investor receives a tax credit for the amount of tax paid. By way of example, if the distribution is $5 fully franked, the franking (tax) credit would be $2.14, making the total distribution (grossed up) $7.14.

ANZ Capital Notes

The ANZ capital notes are a security issued by ANZ Bank, who just released a record half year profit result. The securities were issued at $100 and will pay half yearly distributions at a rate of 3.4% over the 90 day Bank Bill Swap rate (currently 2.68%) which today equates to 6.08%. This is what is called a floating rate security as the interest rate that you receive will move up and down with the official cash rate, which removes interest rate risk.

The securities have an expected term of 8 years (with mandatory conversion after 10), but are listed on the stock exchange meaning that they are liquid (i.e. investors can sell the securities on market so do not need to hold the securities for the full term). This does mean that if not held for the full term the investor is taking some capital risk. ANZPE’s are currently trading at $101.58.

We would expect that at the first call date (8 years’ time) a good corporate, who regularly comes to market to raise capital such as ANZ, will repay investors their $100, as they have with every such issue in the past. However to comply with banking regulations the securities must have the ability to convert to equity (shares in ANZ) given certain events if they are to be counted as bank equity for capital purposes. These knock out events are what some in the media have focused on, describing the securities as “High Risk”.

Some perspective on the trigger events for mandatory conversion:

The first trigger event is if ANZ’s capital (tier 1 capital ratio) falls below 5.125% from the current level of 8.3%. Wiping out 40% of the banks’ capital would require an event significantly greater than the Global Financial Crisis. For this to happen, we would also have to be in an environment where ANZ could not raise additional capital from markets (i.e. issue new shares) and does not receive any government support. This could happen, but in our view and in the current environment, is highly unlikely.

If a non-viability event occurred, the maximum number of ordinary fully paid ANZ shares that each security can be converted into is 15.4799. This means that the ANZ share price would have to trade below $6.46 (current share price $33.75) for holders of ANZPE to lose capital.

At FYM we focus only on high quality issuers, where we are comfortable that distributions will always be paid. We are also very cognisant of the economic and interest rate cycle and the type of fixed income securities that should be held.

Right now and in this low interest rate environment, we remain very comfortable with securities such as ANZPE and will remain active participants in any similar upcoming issues.